Published:

Updated:

PancakeSwap (https://pancakeswap.finance/swap) is one of the leading and most sought-after decentralised exchanges (DEX) in the cryptocurrency market. Launched in 2020, it has quickly gained a reputation as a reliable platform thanks to its operation on the BNB Smart Chain blockchain (formerly Binance Smart Chain), which ensures high transaction throughput and minimal fees. PancakeSwap provides an extensive set of tools for exchanging digital assets, providing liquidity, generating income through farming1 and participating in a variety of gaming and socio-economic initiatives.

History of the Exchange

PancakeSwap was launched in September 2020 by an anonymous team of developers. Unlike Uniswap, which ran on Ethereum, the new platform used Binance Smart Chain, which significantly reduced transaction fees. The core of the ecosystem was the CAKE token, which fulfils the functions of rewards, staking and management via DAO2.

The year 2021 was a turning point for PancakeSwap. Against the backdrop of the DeFi boom and high commissions in Ethereum, users switched to BSC en masse. The exchange introduced new features such as Syrup Pools (the ability to steak3 CAKE and receive other tokens) and Lottery (a lottery with CAKE prizes), which attracted even more participants. Already in March 2021, the total blockchain value (TVL) in the protocol exceeded $5bn, and in May of the same year, the second version of the platform (v2) was released, which made trading even more efficient.

During its existence, PancakeSwap has not encountered critical vulnerabilities in the protocol that would lead to hacking of smart contracts or direct theft of user funds. However, several incidents have affected the platform’s reputation and highlighted the potential risks of operating in a DeFi environment.

One of the most serious cases occurred in March 2021, when attackers attempted a DNS attack on pancakeswap.finance. Their goal was to redirect users to a phishing site to gain access to their wallets. While the attack did not result in a hack of the protocol itself, it caused panic among investors, which temporarily collapsed the value of the CAKE token by almost half. The PancakeSwap team quickly eliminated the threat, but the incident clearly demonstrated the vulnerability of even large DeFi projects to such attacks.

Another problem faced by PancakeSwap users is fraudulent tokens. Since anyone can create and place a token on a decentralised exchange, fraudsters often issue so-called ‘honeypot tokens’ – assets that can be bought but cannot be sold. Newbies, without verifying the contract, sometimes fall victim to such schemes, losing funds. It is important to realise that these cases are not related to the shortcomings of PancakeSwap, but to the general risks of trading on DEX.

In addition, it is worth noting that the BNB Chain blockchain on which PancakeSwap operates has been periodically attacked, including hacks of other DeFi protocols. However, PancakeSwap itself demonstrates resilience – no successful attacks on its smart contracts have been recorded during its entire existence.

Thus, PancakeSwap remains one of the most reliable DEX solutions in terms of protocol security. Nevertheless, users should be vigilant: check token contracts before trading, use only official sites, and include additional security measures such as hardware wallets.

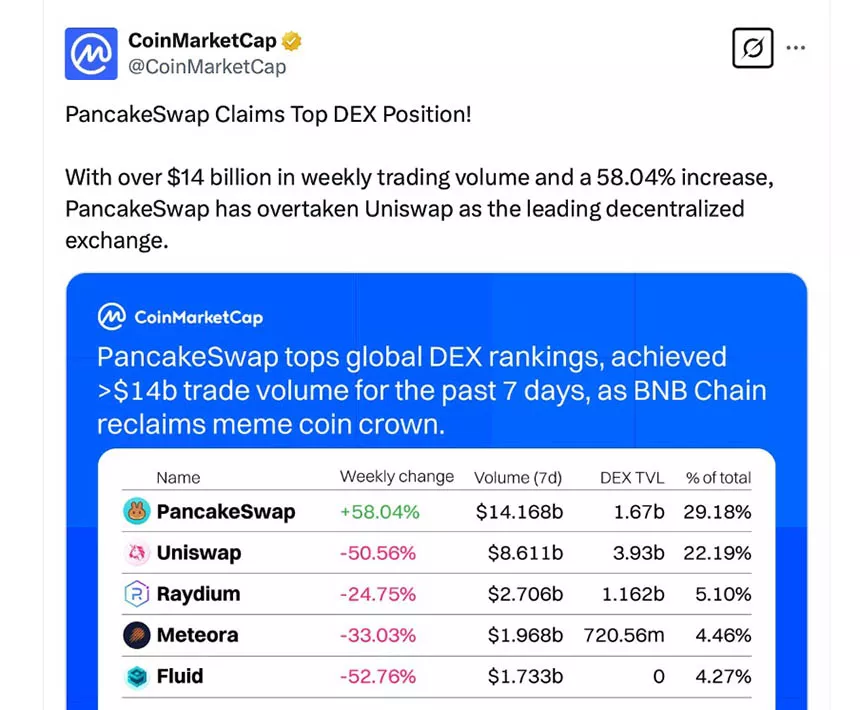

Over time, PancakeSwap stopped being just an exchange and evolved into a feature-rich DeFi platform. In 2021, an NFT marketplace was introduced, and later the exchange expanded support to other blockchains, including Polygon, Aptos, Arbitrum and Ethereum. Another important step was the launch of IFO (Initial Farm Offerings), a mechanism that allows new projects to raise liquidity through CAKE staking. In 2023, the third version (v3) was released, adding a concentrated liquidity feature similar to Uniswap v3. In March 2025, the next era for PancakeSwap began when it was able to overtake Uniswap in terms of weekly trading volume.

Exchange Statistics

As of 15 May 2025, PancakeSwap is showing impressive results. The platform has a total liquidity of $1.23 billion. According to Coinmarketcap (https://coinmarketcap.com), back in March 2025, PancakeSwap was able to surpass Uniswap in terms of weekly trading volume.

According to the Gate Learn report PancakeSwap has significantly strengthened its position in March 2025, surpassing Uniswap in trading volume.

PancakeSwap’s daily volume totalled $254 million, while Uniswap posted $132 million. The dynamics were also on PancakeSwap’s side: weekly volume grew by 60.72%, while Uniswap’s decreased by 43.93%. Lower fees and high transaction speeds on the BNB Smart Chain, as well as the growing popularity of meme tokens, were key factors in PancakeSwap’s success. This was also reflected in daily commissions, which totalled $61,700 versus Uniswap’s $13,200. Despite this, Uniswap maintains its lead in TVL at $39.3bn, compared to PancakeSwap’s $24bn.

According to Dune analytics (https://dune.com/home) PancakeSwap completed a record first quarter of 2025 with a trading volume of $205.3bn, becoming a leader in the DeFi space. Since 2020, the platform has grown from an AMM on BNB Chain to a DEX multichain, showing significant growth in user engagement and ecosystem activity.

The first quarter of 2025 saw record highs:

- $205.3bn of total trading volume.

- 5.83 million unique traders.

Since 2023, PancakeSwap has seen steady growth, increasing quarterly trading volume by 922% and number of traders by 81%. The number of transactions has grown by 159%. Growth is driven by multichain expansion and innovations including PancakeSwap v3 and PancakeSwapX. PancakeSwap has strengthened its position on BNB Chain, Base, Arbitrum and Ethereum. Further growth is expected in Q2 2025 due to its loyal community and focus on innovation.

Operating Principle

Like most decentralised crypto exchanges, PancakeSwap uses an Automated Market Maker (AMM4) model that allows users to trade directly from their digital wallets, eliminating the involvement of intermediaries and the need for registration. Thanks to this approach, the project has consolidated its position as one of the leaders among DEXs in terms of trading volume and number of active users, and has become an integral part of the Binance Smart Chain ecosystem.

PancakeSwap is currently one of the leading decentralised exchange (DEX) and DeFi applications on the BNB Smart Chain in terms of total blockchain value (TVL), accumulating assets valued at approximately $1.62 billion. The distribution of assets across other supported blockchains suggests less intensive usage on these platforms. In addition, PancakeSwap has its own governance token, CAKE, through which holders are able to participate in voting on key issues. CAKE also serves as an incentive tool for liquidity providers and participants in steaking programmes.

PancakeSwap operates based on the Automated Market Maker (AMM) principle, which eliminates the need for a traditional order book and trade intermediation. Transactions are conducted through liquidity pools, which are smart contracts into which users deposit paired tokens, thereby enabling exchanges. Each pool contains reserves of two tokens, and the AMM algorithm autonomously determines the price and provides an exchange between them, eliminating the need to search for a counterparty.

In return for providing tokens to liquidity pools, users receive LP5 (Liquidity Provider) tokens certifying their share in the respective pool. These liquidity providers receive revenue in the form of commissions from each transaction that passes through the pool and have the opportunity to participate in pharming by blocking their LP tokens to receive additional rewards in CAKE tokens, which are the platform’s own asset.

To optimise the swap process, PancakeSwap uses Smart Router, which is an intelligent routing engine that routes transactions through different liquidity sources (PancakeSwap V2, V3, StableSwap and others), thus ensuring the most favourable prices and minimal slippage on swaps.

Interface

PancakeSwap offers an intuitive web interface that combines simplicity for beginners with extensive features for experienced DeFi users. The platform features a clever organisation of the main functions accessible via a navigation menu.

The centrepiece is the token exchange section (Swap), where users can quickly make transactions. Nearby are sections for Liquidity management (Liquidity), yield farming (Farms) and steaking (Pools). Separate tabs lead to the NFT Marketplace and the IFO Initial Offerings Marketplace.

To get started, all you need to do is click the ‘Connect Wallet’ button in the top right corner. The platform supports all popular crypto wallets, including MetaMask, Trust Wallet, Coinbase Wallet and hardware solutions like Ledger. When you first connect, the system can automatically configure your wallet to work with Binance Smart Chain.

Users can create a personalised NFT profile, participate in team activities and complete tasks to earn rewards. A recent update with the integration of Brevis’ zk-Proof6 technology added elements of personalisation, including adaptive trading commissions and bonus programs.

Usage Guide

- Install a compatible wallet and top up it with BNB to pay commissions.

- Connect the wallet via the official PancakeSwap website.

- Under Swap, select tokens to exchange and confirm the transaction.

- In Liquidity, you can provide liquidity by getting a share of trading commissions.

- The Farms and Pools sections allow you to earn from steaking CAKE and LP tokens.

- Through IFO7, you can participate in new project launches.

- The NFT marketplace offers opportunities for collectors and creators.

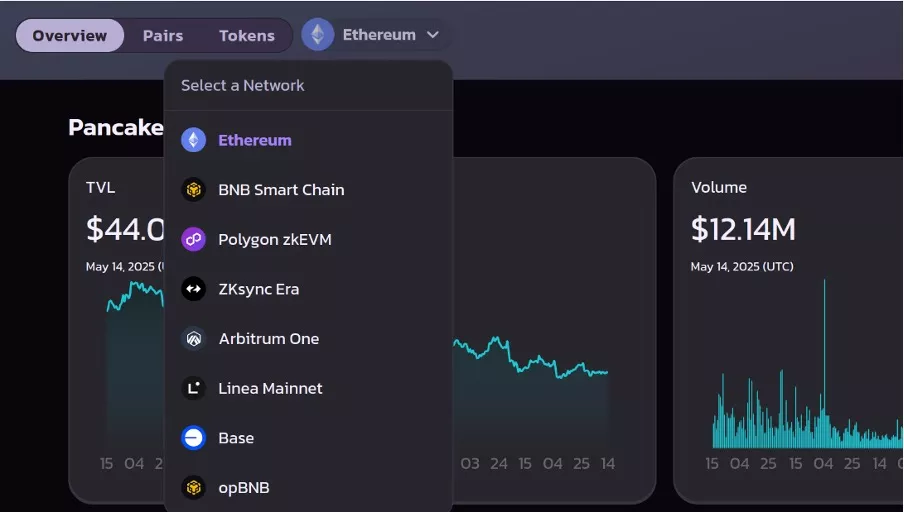

PancakeSwap Supported Blockchains

Although PancakeSwap’s main blockchain is the BNB Smart Chain, over time PancakeSwap has evolved from a simple decentralised exchange on the BNB Chain to a full-fledged multichain platform supporting multiple blockchains. This expansion allowed it to reach a wider audience and offer users a choice between different networks depending on their needs for speed, transaction costs and available assets.

BNB Smart Chain

BNB Smart Chain (formerly Binance Smart Chain) is the main blockchain. BNB Chain remains the flagship network for PancakeSwap, providing:

- Ultra-low fees (less than $0.1 per swap)

- Instant transactions (~3 seconds for confirmation)

- Deep liquidity thanks to integration with the Binance ecosystem. This is where PancakeSwap first launched and still maintains the highest trading volume and user activity.

The main problem with many blockchains, including Ethereum, is high fees that make frequent transactions unprofitable. BNB Chain solves this problem with its architecture based on the Proof of Staked Authority (PoSA8) consensus mechanism. Transactions are processed in just 3 seconds and swap costs rarely exceed $0.1, making the network attractive to traders of all levels.

Speed and cost-effectiveness are not the only pluses. Full compatibility with the Ethereum Virtual Machine (EVM) allows developers to easily migrate projects from Ethereum and users to work with familiar tools such as MetaMask and Trust Wallet. This makes it much easier to migrate from other networks and help the ecosystem grow.

BNB Chain is sometimes criticised for being less decentralised than Ethereum or Solana, as validators are selected with Binance’s involvement. However, for decentralised exchanges, this is more of an advantage: the network is stable without frequent congestion, and transactions remain predictable in value and speed. PancakeSwap, like many other DEXs, chooses the optimal balance between decentralisation and convenience.

Ethereum

Ethereum needs no introduction. Ethereum support allows PancakeSwap to work with:

- ERC-20 standard tokens (including USDT, USDC, DAI stablecoins).

- Access to institutional investors and large traders.

- Security and decentralisation of the most reliable smart contract platform.

However, due to high fees, Ethereum is used in pancakeswap.finance mainly for large transactions and interoperability with other DeFi protocols.

Base

Base is a Layer 2 blockchain built on Ethereum and developed by CoinbaseBase, built on OP Stack (Optimism technology). Its advantages are:

- Speed and low commissions (like Arbitrum and Optimism).

- Direct integration with Coinbase (simple fiat on-ramping).

- A growing ecosystem of new DeFi and NFT projects.

PancakeSwap on Base has become a great alternative for users looking for an Ethereum-compatible but cheap option.

OpBNB

OpBNB is an analogue to Base, but optimised for the BNB Chain. Its key features:

- Even lower fees than the main BNB Chain.

- Full compatibility with EVM and BSC tools.

- Improved throughput for highly loaded dApps.

This solution makes PancakeSwap even more accessible to BNB Chain users, reducing the load on the core network.

Aptos

Aptos is a new L1 blockchain created by former Diem (Meta) developers. PancakeSwap maintains it to:

- Embrace an alternative ecosystem outside of EVM.

- Utilise high speed (up to 100k TPS).

- Work with the Aptos Foundation’s support team.

Volumes on Aptos are small for now, but this is a strategic direction for future growth. Polygon zkEVM, zkSync Era, Arbitrum One, Linea – Ethereum L2 solutions

Layer 2 Ethereum Networks

PancakeSwap is also integrated with leading Layer 2 Ethereum networks:

- Polygon zkEVM – ZK-rollup9 with low fees.

- zkSync Era – an up-and-coming L2 ZK-stacking network.

- Arbitrum One – the largest Optimistic Rollup.

- Linea (from Consensys) – a new ZK rollup with a focus on DeFi.

These integrations allow PancakeSwap to remain the main cross-chain DEX in the Ethereum ecosystem.

Cake Native Token

PancakeSwap’s native cryptocurrency token called CAKE plays a central role in the functioning of this decentralised platform. This BEP-20-compliant digital asset on the Binance Smart Chain blockchain not only provides fast and cheap transactions, but also fulfils several important functions in the ecosystem.

The main purpose of the CAKE token is to enable users to participate in the management of the platform. Token holders get the right to vote for protocol development proposals, making PancakeSwap a truly decentralised project. In addition, CAKE serves as a tool for passive income generation through steaking and farming mechanisms, where users can earn additional tokens.

An important function of CAKE is its use in the reward system of liquidity providers. The token acts as an incentive for participants providing liquidity to trading pairs and is also used to cover transaction fees within the platform. Such multifunctionality makes CAKE not just a means of exchange, but a full-fledged economic tool of the ecosystem.

CAKE tokenomics deserves special attention. The total supply of tokens is limited to 450 million units, with 321 to 373 million in circulation. To maintain balance and control inflation, the developers have implemented a mechanism for regular token burning, which over time could turn CAKE into a deflationary asset and increase its value.

CAKE’s market performance demonstrates the sustained interest in the asset. The token price has stabilised in the range of $2-4 in 2025, with analysts forecasting a potential increase to $3.6 in the coming years. In case of favourable development of the DeFi sector and expansion of PancakeSwap’s functionality, the possibility of reaching price points of around $100 per token is not excluded.

CAKE’s importance is underscored by its impressive financials: the market capitalisation exceeds $1 billion and the total blocked value (TVL) on the platform is in the billions. These figures demonstrate the high level of user trust and the active development of the ecosystem.

For market participants, CAKE is not just a trading instrument, but an important component of a decentralised financial system. Opportunities to generate income through staking, participation in platform management, and prospects for value growth make this token attractive to both long-term investors and active participants in the DeFi sector. With its versatility and sound economic model, CAKE continues to strengthen PancakeSwap’s position as one of the leading decentralised exchanges in the cryptocurrency industry.

Commissions

PancakeSwap uses a transparent and cost-effective commission model based on the capabilities of the BNB Smart Chain network. The main costs for users are BNB’s gas fees and a small percentage for exchange transactions. Token exchanges are charged a standard commission of 0.25 per cent of the transaction amount. These funds are distributed in three ways: the main part (0.17%) goes to liquidity providers as remuneration, 0.03% is destroyed through a burn mechanism to regulate the CAKE token issue, and the remaining 0.05% goes to the platform’s development fund.

The main advantage of PancakeSwap is minimal transaction costs due to the use of BNB Smart Chain. The average cost of transactions here is a fraction of a cent, which is many times lower than similar costs in the Ethereum network. For any transactions on the platform, users need to have a small stock of native BNB token on their wallet to cover gas charges.

An important feature of PancakeSwap is the absence of hidden fees typical of centralised exchanges. The platform does not charge additional fees for depositing or withdrawing funds, as all transactions are performed directly through the blockchain. The only exception is the use of third-party services for fiat transfers, where providers’ own tariffs may apply.

Thanks to the optimal distribution of commission fees and the use of a highly efficient blockchain infrastructure, PancakeSwap remains one of the most cost-effective decentralised exchanges on the market. This policy makes the platform particularly attractive for active participants in the DeFi sector who regularly make multiple transactions with digital assets.

Customer Support

PancakeSwap does not provide an official customer support team that can be contacted directly. However, a ‘Troubleshooting Errors’ section is available on the PancakeSwap website, which describes common problems, such as ‘too much price impact’ or ‘PancakeSwap router expired’, and suggests solutions and explains why they occurred.

Despite the absence of an official support service, users can ask for help from the community via Telegram and Discord chats. Judging by the feedback from many users, PancakeSwap’s Telegram channel is more active and quicker to respond than the Discord channel. It is important to be aware of scammers masquerading as ‘support lines’ or ‘customer service’ and offering help – never enter into correspondence with them. It is recommended that you change your privacy settings to block such messages.

Users trading open-ended futures on PancakeSwap can use the support request system via the ApolloX platform, which guarantees timely assistance with any issues that may arise.

To Summarise

PancakeSwap has established itself as one of the most popular and reliable decentralised exchanges in the world of cryptocurrencies. Since its launch in 2020, the platform has grown rapidly, offering users not only token exchanges but also a wide range of DeFi tools including farming, staking, NFT marketplace and cross-chain integration.

By running on the BNB Smart Chain, PancakeSwap offers high transaction speeds and minimal fees, making it attractive to beginners and experienced traders alike. The introduction of Smart Router, concentrated liquidity (v3) and support for multiple blockchains, including Ethereum, Base, Arbitrum and Aptos, has allowed the project to take a leading position in the DeFi sector.

The CAKE token plays a key role in the ecosystem, providing governance through DAOs, staking and rewards for liquidity providers. Its elaborate tokenomics, including a burn mechanism, contributes to the long-term sustainability of the project.

Despite the lack of centralised support, PancakeSwap maintains an active community, and its security and stability is proven by the absence of critical vulnerabilities in smart contracts. In 2025, PancakeSwap continues to strengthen its position by overtaking competitors in terms of trading volume and innovation. As the DeFi sector grows and functionality expands, the platform remains one of the most promising projects in the world of decentralised finance.

Bottom line: PancakeSwap is a powerful, convenient and cost-effective DEX that is suitable for both passive income and active trading. Its development and adaptation to new trends make it a great choice for crypto-enthusiasts.

Interested in cryptocurrencies and everything related to it

- What is farming?

Farming (also known as “yield farming”) is the process of earning income in cryptocurrencies by providing them as liquidity on decentralized finance (DeFi) platforms. Rewards are given for locking assets in liquidity pools or participating in DeFi protocols. ↩︎ - What is a DAO?

A DAO (Decentralized Autonomous Organization) is an organization governed by smart contracts. Decisions are made collectively through voting using native tokens, and all operations follow transparent, clearly defined rules written into smart contracts. ↩︎ - What is staking?

Staking is the process of locking crypto assets in a blockchain network to help maintain its operation and security. In return, you receive rewards in the form of crypto assets. It is a form of passive income earned by simply holding cryptocurrency. ↩︎ - What is an AMM?

An AMM (Automated Market Maker) is a type of decentralized exchange that uses algorithms and liquidity pools for cryptocurrency trading. It automates the trading process, enabling asset swaps without traditional intermediaries. ↩︎ - What are LP tokens?

LP tokens (Liquidity Provider tokens) are a type of digital asset issued to users who deposit cryptocurrencies into liquidity pools on DEX platforms. They represent a user’s share in the pool and allow them to earn rewards for providing liquidity. ↩︎ - What is a zk-Proof?

zk-Proof (Zero-Knowledge Proof) is a cryptographic protocol that allows one party to prove the truth of a statement to another without revealing any additional information. ↩︎ - What is an IFO?

An IFO (Initial Farm Offering) is a fundraising model used by decentralized finance (DeFi) projects to raise capital through farming features. IFOs are a successor to Initial Coin Offerings (ICOs), aimed at securing financial support for crypto project development. ↩︎ - What is Proof of Staked Authority (PoSA)?

Proof of Staked Authority (PoSA) is a hybrid system where blocks are created by selected validators with the highest amount of staked coins and verified reputation. It combines the security and economic incentives of PoS with the speed and manageability of PoA. ↩︎ - What is a ZK-rollup?

A ZK-rollup (Zero-Knowledge Rollup) is a technology that bundles thousands of transactions into a single batch processed off-chain, and then publishes a short cryptographic proof (zk-proof) to the network confirming that all operations are valid. ↩︎